A recent article highlighted that the European Commission has warned Malta to amend its car licensing rules to bring them in line with the other member states with a 2 month notice before setting course for legal action.

All car owners know that owning a car in Malta has never been cheap. The largest expense and hurdle was the "Registration tax", also known as the import charges, were in some instances a car owner would be charged more tax than the car is worth. The situation has been improved significantly since the 2009 legislation, but nevertheless its still very expensive.

Our argument is for:

- Used Car - Tax already paid from the origin country

- EU Registered - The car has already been registered in an EU country.

***********************************************

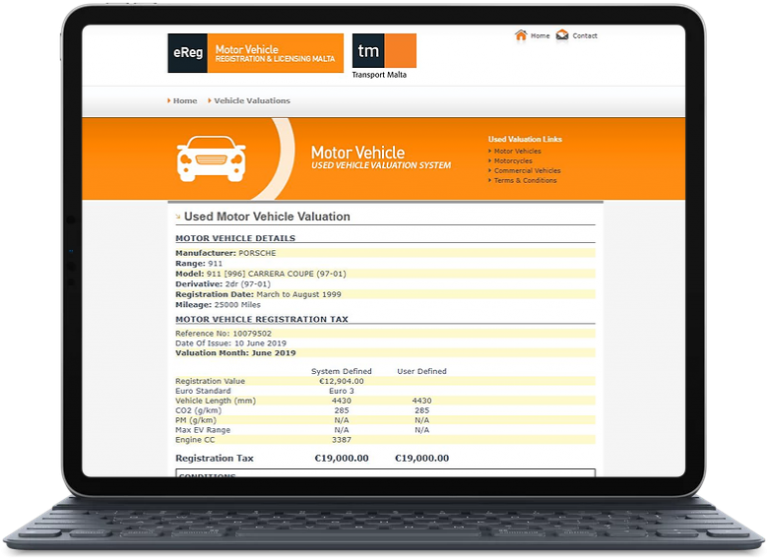

For example, lets take a 1999 Porsche 911 [996] Carrera with 25000 miles from Germany to register the car in the:

- UK

- MOT - £54.85

- Certificate of Conformity - £60

- Mutual Recognition Certificate - £65

- DVLA Administration Charges - £38

- Year of Road Tax - £570 (Tax Band M)

- Registration (Import Charges) - €0

- Total: €886 (£787.85)

- Malta

- VRT (MOT equivalent) - €20.27

- JEVIC Certificate - €40 (£34.20)

- Inspection - €50

- Administration Charges - €15

- Year of Road Tax - €1125 (at maximum)

- Registration (Import Charges) - €19000

- Total: €20250

Summary: In Malta you pay 23 times more to register your sports car when compared to the UK.

***********************************************

And another example, lets take a 2015 Toyota Yaris in petrol with 95000 miles from Germany to register the car in the:

- UK

- MOT - £54.85

- Certificate of Conformity - £60

- Mutual Recognition Certificate - £65

- DVLA Administration Charges - £38

- Year of Road Tax - £30 (Tax Band C)

- Registration (Import Charges) - €0

- Total: €280 (£247.85)

- Malta

- VRT (MOT equivalent) - €20.27

- JEVIC Certificate - €40 (£34.20)

- Inspection - €50

- Administration Charges - €15

- Year of Road Tax - €125 (can increase up to €339)

- Registration (Import Charges) - €878

- Total: €1128

Summary: In Malta you pay 4 times more to register your economic car when compared to the UK.

***********************************************

The charges will differ depending on the age, mileage, length and emissions of the car, but nevertheless the difference that the Maltese Authority are charging is staggering high. In addition the calculation which favors higher mileage cars is proof there is a fault within the system itself.

This is not a debate whether or not we should favor gas guzzlers for economic cars, we are simply comparing like with like in both instances and compare indeed the EU should intervene and help lift the strict import costs that exist in Malta.

The main question is if the authorities will reduce the registration and annual charges for cars imported now onwards, will they increase the taxes for the cars on the old system? The definite answer will present itself during the Malta Budget of 2020, held in October 2019.

References:

Use code carsaddiction for 20% off!